child tax credit october 2021

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October.

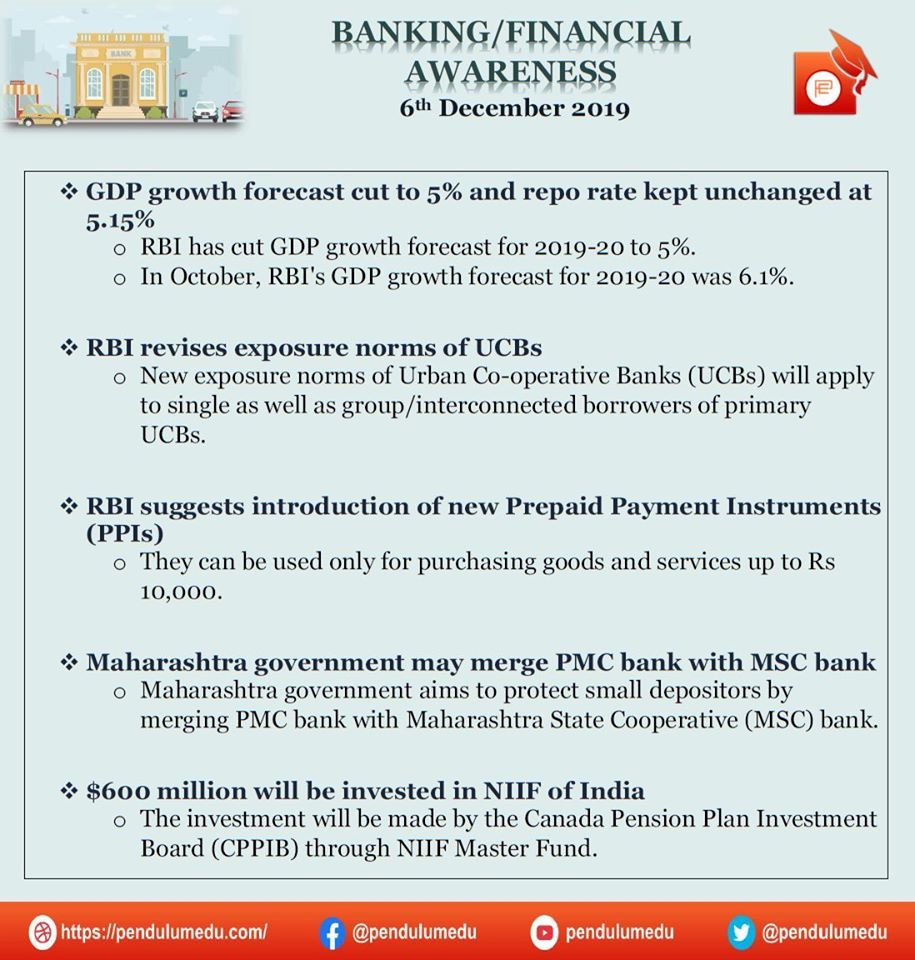

Daily Banking Awareness 06 December 2019 Awareness Financial Banking

If the modified AGI is above the threshold the credit begins to phase out.

. Enter your information on Schedule 8812 Form. That drops to 3000 for each child ages six through 17. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. 3000 for children ages 6 through 17 at the end of 2021. 3600 for children ages 5 and under at the end of 2021.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments. On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. IR-2021-201 October 15 2021.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. We explain the key deadlines for child tax credit in October Credit. Get your advance payments total and number of qualifying children in your online account.

Nearly all families with kids will qualify. The Child Tax Credit is a tax benefit to help families who are raising children. Visit bitly3y5VGU2 to learn more.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Changes in income filing status the birth or death of a child or having a child move into or out of your household may have affected the amount that you are eligible to receive when you file your 2021 tax. The IRS urges grandparents foster parents or people caring for siblings or other relatives to check their eligibility.

Simple or complex always free. COVID Tax Tip 2021-150 October 12 2021 Families come in all shapes and sizes and some families may not realize they could receive advance payments of the 2021 child tax credit in the last months of this year. You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered information into the Non-Filer tool on IRSgov in 2020 or the Child Tax Credit Non-filer Sign-up Tool in 2021.

File a federal return to claim your child tax credit. Complete Edit or Print Tax Forms Instantly. That means parents who.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. So each month through December parents of a younger child are receiving 300 and parents of an older child are receiving 250. The child tax credits are worth 3600 for kids below six in 2021 3000 for those between six and 17 and 500 for college students aged 18 to 24.

The 2021 advance monthly child tax credit payments started automatically in July. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return. Advance Child Tax Credit payments were made for qualifying.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money.

The IRS will soon allow claimants to adjust their income and custodial. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. For 2021 the credit phases out in two different steps.

To reconcile advance payments on your 2021 return. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

Access IRS Tax Forms. The first half of the credit will be sent as monthly payments of up to 300 for the rest of 2021 and the second half can be claimed when parents file their income tax returns for 2021. Couples making less than 150000 and single parents also called Head of Household making less than 112500 will qualify for the additional 2021 Child Tax Credit amounts.

As part of the continuing process of building out the advance CTC program which has included outreach to bring in previous non-filers and the launch of the CTC Update Portal that has allowed millions of. The 500 nonrefundable Credit for Other Dependents amount has not changed. The fourth advance child tax credits payment will land in bank accounts and as paper checks on October 15.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in 2021. The Child Tax Credit reached 611 million children in October and on its own contributed to a 49 percentage point 28 percent reduction in child poverty compared to what the monthly poverty rate in October would have been in its absence.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

Publication 721 2018 Tax Guide To U S Civil Service Retirement Benefits Internal Revenue Service Tax Guide Retirement Benefits Internal Revenue Service

Family Circus 4 15 10 Gif 320 367 Family Circus Family Guy Character

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Mtar Technologies Ipo Md Srinivas Reddy Speaks To Anil Singhvi On Business Outlook Order Book Rivals And More In 2021 Order Book Technology Business

H R Block Reports Revenue Growth In Fiscal 2021 Second Quarter Hr Block Revenue Growth Dividend

Input Tax Credit Tax Credits Indirect Tax Tax Rules

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

October 2021 Cpa Exam Changes Cpa Exam Cpa Cpa Review

17 Dividend Stocks For Daily Cash Flow Cash Flow Energy Sector Dividend

Tds Due Dates Due Date Make It Simple Generation

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank

Pdf Ebook South Western Federal Taxation 2021 Comprehensive 44th Edition By David M Maloney Ja Buy Ebook Ebook Online Taxes