how long does the irs collect back taxes

Assessment is not necessarily the reporting date or the date on. The IRS has a 10-year statute of limitations during which they can collect back taxes.

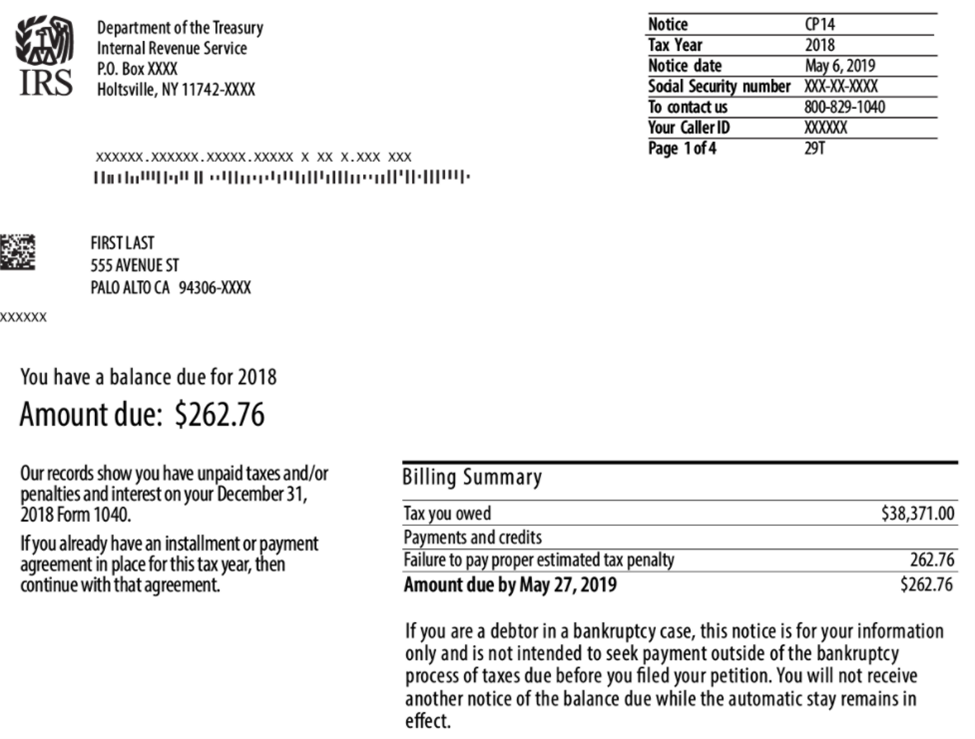

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

After this 10-year period or.

. After this 10-year period or statute of. The IRS has a limited amount of time to collect back taxes. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

With the Interactive Tax Assistant at IRSgovITA. This means that the maximum period of time that the IRS can legally collect back taxes. 201 The Collection Process.

Please dont hesitate to contact us with any questions you may have. You can find answers. How far back can the IRS collect unpaid taxes.

The IRS 10 year window to collect. If your statute is close to expiring the IRS may get even. The IRS generally has 10 years from the date of assessment to collect on a balance due.

For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. For a lot of people that statement right there will help them breathe a sigh of relief. After the IRS determines that additional taxes are.

How Long Does The IRS Have To Collect Back Taxes. But the agency cant chase you forever. Failing to pay your taxes may lead to IRS collection activities.

That statute runs from the date of the assessment. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

This bill starts the collection process which. If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. GET PEACE OF MIND.

Make IRSgov your first stop for your tax needs. This is known as the statute of. How Long Does The IRS Have To Collect Back Taxes.

6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual. The Internal Revenue Service the IRS has ten years to collect any debt. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

Knowing how long the IRS has to collect back taxes is essential to finding the best possible resolution for your individual case. Code 6501 Limitations on. When it comes to tax the main exceptions to the 3- or 6-year SOL is codified in 26 US.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. The collection statute expiration ends the. How long can the IRS try to collect back taxes.

Lets start with the good news. According to Internal Revenue Code Sec. As stated before the IRS can legally collect for up.

Essentially the IRS is mandated to collect your unpaid taxes within. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. Learn more about the IRS Statute of Limitations here.

If you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe. This means that under normal circumstances the IRS can no longer pursue collections action against you if. As already hinted at the statute of limitations on IRS debt is 10 years.

Wealthy Americans Escape Tax Hikes But Would Face Beefed Up Irs Bloomberg

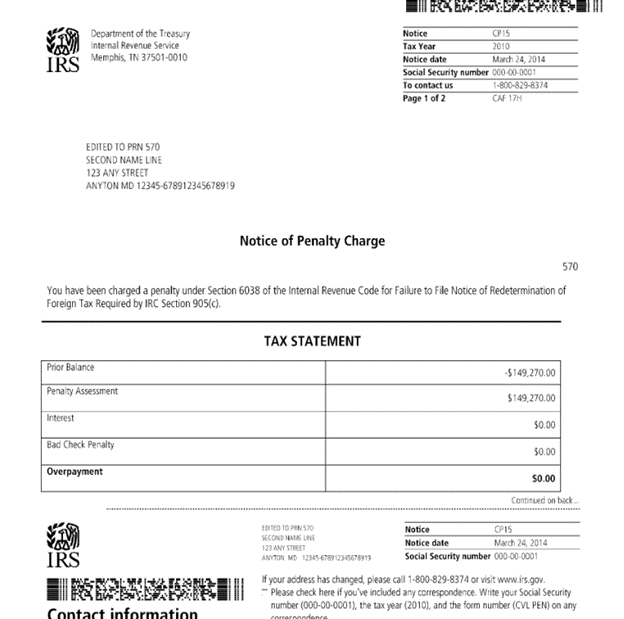

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

How Social Security Garnishment Works With Federal Back Taxes

How Long Does The Irs Have To Collect Back Taxes Youtube

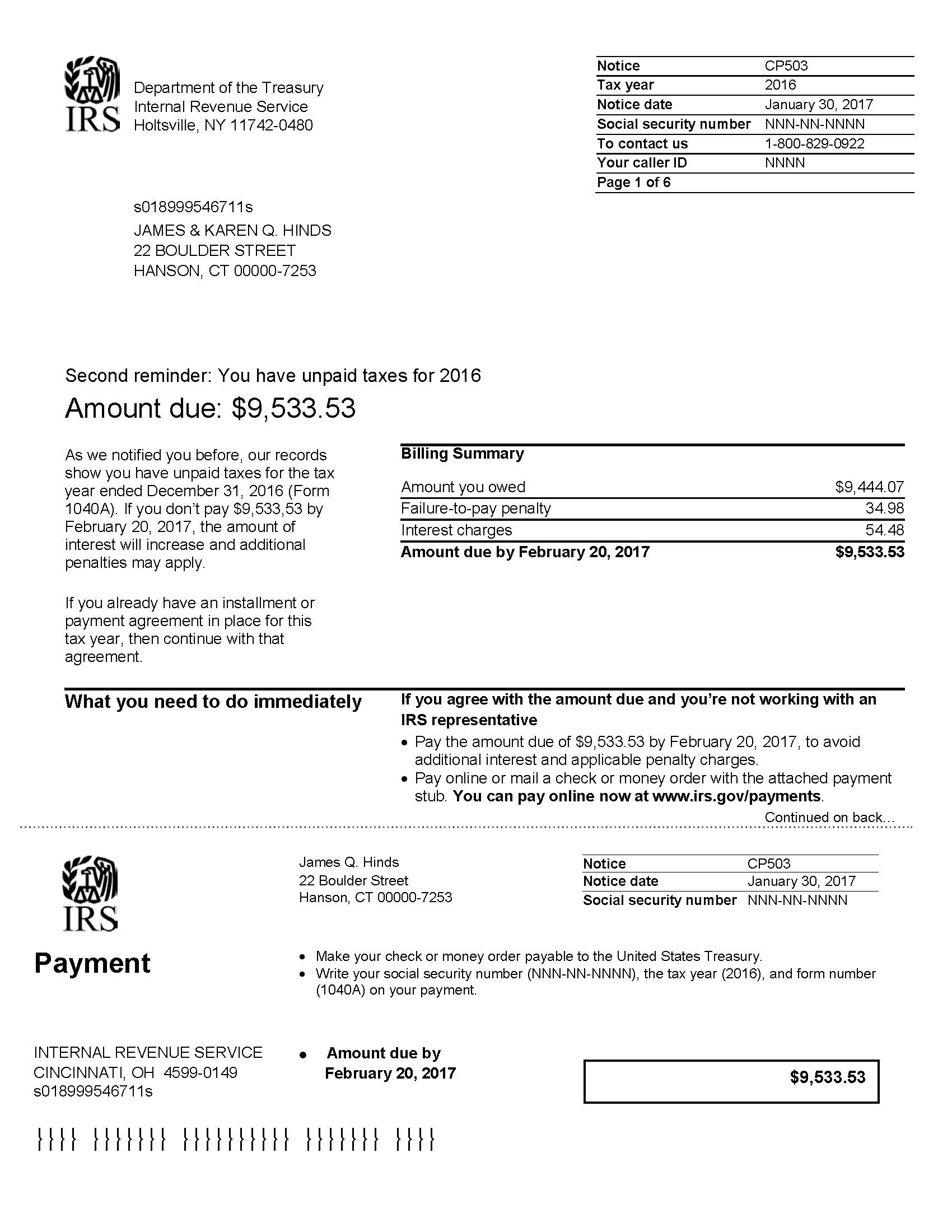

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

The Irs Wants To Use Mobile Tech To Collect Overdue Taxes Fedtech Magazine

Are There Statute Of Limitations For Irs Collections Brotman Law

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

Irs Statute Of Limitations How Long Can Irs Collect Tax Debt

The Irs Is Sending Millions Of Tax Payment Letters This Month Don T Ignore Them Cbs News

Video Irs 1099 Levy Contractor Options Turbotax Tax Tips Videos

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Can The Irs Take Or Hold My Refund Yes H R Block

Column The Irs Hired Bill Collectors To Collect Back Taxes And Got Ripped Off Los Angeles Times

Best Way To Pay Your Back Taxes And Get Relief Forbes Advisor Forbes Advisor